2025: the year the market blinked. For the first time since 2005, craft beer crossed a sobering milestone. More breweries closed than opened. The industry recorded 399 closures and only 335 openings, a symbolic inversion marking a shift into true contraction. It marked the beginning of something more significant than a blip or a bad quarter. It marked the start of a structural correction.

By mid-2025, the contraction was not only real but accelerating. Volumes were down 4.1%. Active breweries dropped to 9,269, the lowest level in years.

Brewers Association President Bart Watson didn’t mince words, calling this “a painful period of rationalization.” But for many, that description undersells the emotional reality. It’s hard to watch neighboring breweries shutter and not wonder whether your own is next.

Yet even amid closures, some breweries are gaining ground, bucking the trend.

They’re gaining because their operations are sharper, data is available in real-time, and margins aren’t a mystery. They know their costs, capacity and cash flow with precision, allowing them to move confidently while others freeze.

This widening operational divide raises a critical question: What can breweries do now to position themselves on the winning side in 2026?

Why Did the Craft Beer Market Contract in 2025?

Craft beer is contracting due to sustained volume declines, rising operating costs, distributor consolidation, and retailers reducing craft SKU counts across key markets.

The industry has always been cyclical, but 2025 marked a turning point that feels fundamentally different from previous dips. What distinguishes this downturn is not only the scale of closures but the breadth of pressure applied from all sides of the supply chain.

Once the engine of craft growth, microbreweries saw a 3% decline, while taprooms dipped by 1% as evidenced by:

- Significant state-level closures in cornerstone craft states such as California, Oregon and Washington.

- Three-year contraction in the Beer Purchasers Index, signaling sustained buyer pullback rather than momentary hesitation.

For the first time, the industry is confronting structural equilibrium, meaning a market can no longer absorb new entrants or maintain expansion without corresponding demand.

In this environment, operational inefficiencies no longer hide politely in the background. They show up in plain financial daylight.

Why Doesn’t Great Beer Guarantee Survival in Today’s Market?

Quality alone no longer protects breweries, as rising costs, reduced shelf space and consumer shifts require strong financial and operational discipline.

The crop of closures isn’t a referendum on beer quality. Many shuttered breweries made exceptional beer. The real culprits are systemic and unrelenting:

- Retailers are narrowing assortments: Shelf sets are shrinking, and high-turning brands are prioritized.

- Distributors are consolidating portfolios: Fewer craft SKUs are making the cut.

- Consumer spend is shifting: More dollars flow to RTDs, spirits and NA alternatives.

- Input costs continue to rise: No relief in sight for malt, hops, packaging or energy.

- Market fatigue is real: Oversaturation has diluted consumer attention.

- Operations are more complex: Running a brewery requires financial rigor, not improvisation.

Breweries that once operated on instinct are now being forced into a new reality in which the producers who know their numbers survive, and the ones who think they know their numbers won’t.

This isn’t a creative problem. It’s an operational one.

Why Do Most Breweries Lack True Cost Visibility?

Most breweries lack integrated systems that track batch-level COGS, labor, overhead and packaging in real time, creating financial blind spots that undermine margin control.

Talking to brewery leaders about their pain points reveals the same themes again and again. The vast majority of breweries can’t accurately measure their own profitability.

There’s a knowledge gap quietly sinking breweries. Many breweries still cannot:

- Break down true COGS per beer with full labor, overhead, packaging and utilities allocation.

- Identify margin erosion before the quarter closes.

- Understand which package formats are actually profitable (12-packs vs. 6-packs vs. draft).

- See where ingredient volatility is hitting them hardest.

- Model the impact of a recipe change, a price change or a volume dip.

- Quickly understand which SKUs are quietly cannibalizing cash flow.

- Produce financial reporting that aligns with operational reality.

This isn’t about diligence. These breweries lack integrated systems that drive operational excellence.

Why Can’t Breweries Rely on Spreadsheets to Track Costs Anymore?

Spreadsheets only reflect historical data, making them too slow and error-prone for real-time decisions in a contracting market.

Many brewery teams believe they’re tracking costs well. They’re not. They’re tracking hindsight. The true margin picture might not emerge until two or three weeks after month-end close, by which time it’s too late to correct an issue that began mid-batch or address ingredient costs that spiked.

In a contracting market, delayed visibility is dangerous. Decisions made based on outdated numbers are technically possible but highly risky and not something you’d brag about.

What Happens When Breweries Can’t See Their Real Costs?

When breweries don’t have real-time cost clarity:

- Pricing becomes guesswork: You match competitors rather than your true cost structure.

- SKU strategy becomes emotional: “Our fans love it” becomes the justification for keeping a money-losing SKU alive.

- Distribution partnerships suffer: You chase volume without understanding channel profitability.

- Production planning becomes reactive: You overproduce the wrong things and underproduce high-margin winners.

- Leadership alignment evaporates: Everyone debates strategy from their preferred interpretation of the numbers.

Margin compression hits blind breweries hardest.

How Are Successful Breweries Adapting Their Operations?

Winning breweries use real-time cost visibility, disciplined SKU management, and forecasting to protect margins and guide strategic decisions.

The breweries outperforming the market right now do not share a single style, size or geographic footprint. They do share a cultural and operational orientation toward clarity. They run sophisticated operations with a level of discipline once reserved for large production facilities.

How Does Real-Time Cost Visibility Strengthen Brewery Operations?

Daily cost insights help breweries identify margin issues, adjust production plans, and model financial scenarios with precision.

The strongest operators treat COGS as a strategic dashboard. Their teams know daily how much each beer costs, which formats perform, and how rising input costs affect profitability.

They can pinpoint margin erosion almost as soon as it appears. They can adjust forecasts, reorder strategies and even production schedules on the fly.

This level of intelligence improves margins and prevents costly missteps.

How Should Breweries Adjust Their Product Portfolio in a Contracting Market?

Gone are the days of 20–30 SKUs available year-round. Operators with a clear view of margin performance are cutting back, doubling down and refining with purpose.

Clear margin data enables:

- Discontinuing low performers

- Amping up production on winners

- Planning seasonals based on profitability

- Evaluating distribution vs. taproom role

- Aligning styles (lagers, West Coast IPAs, low-ABV) with long-term profitability

The breweries succeeding through realignment are producing less and earning more.

How Can Brewery Technology Improve Operational Resilience?

Modern brewery software integrates financials, inventory, production and forecasting into a single system, enabling clarity and agility.

Operational efficiency is no longer a back-of-house concern for leading breweries. It’s a growth strategy.

If there is a single pattern that spans all thriving breweries in 2025, it’s that they invested in technology before they were forced to.

Why Can’t Breweries Rely on Manual Tools Anymore?

The craft beer environment has reached a level of complexity that manual systems were never designed to handle. You can’t scale a brewery on spreadsheets. You can’t model scenarios, track batch costs or produce accurate financials with disconnected systems.

You can’t expect visibility when your accounting and operations teams only meet once a month.

Modern breweries need:

- Real-time inventory across raw materials, WIP and finished goods

- Integrated financials tied directly to production events

- Batch-level COGS and automated overhead allocation

- Channel profitability analysis

- Demand forecasting connected to production scheduling

- Scenario modeling for strategic decision support

- Mobile access that keeps decision-makers connected everywhere

This kind of infrastructure creates agility in a contracting market.

How Does Industry Consolidation Create Opportunities for Well-Run Breweries?

Consolidation doesn’t only create casualties. It creates opportunities.

Breweries with strong operational discipline become prime acquisition targets. Their clean data, consistent margins and streamlined portfolios command stronger valuations and smoother due diligence.

Disciplined operators can selectively acquire struggling competitors, expand territory, or secure higher-value partnerships with distributors and retailers seeking stable partners.

When market share goes back on the table, the breweries ready to take it will be the ones whose operations run as strongly as their brewhouses.

What Must Breweries Do to Thrive During Industry Rationalization?

Craft beer is recalibrating. The next era belongs to breweries that treat operations as seriously as brewing.

If 2024 was the wake-up call and 2025 was the correction, then 2026 is the year breweries must decide whether to operate reactively or intelligently.

You’re competing against breweries gaining ground daily through operational excellence.

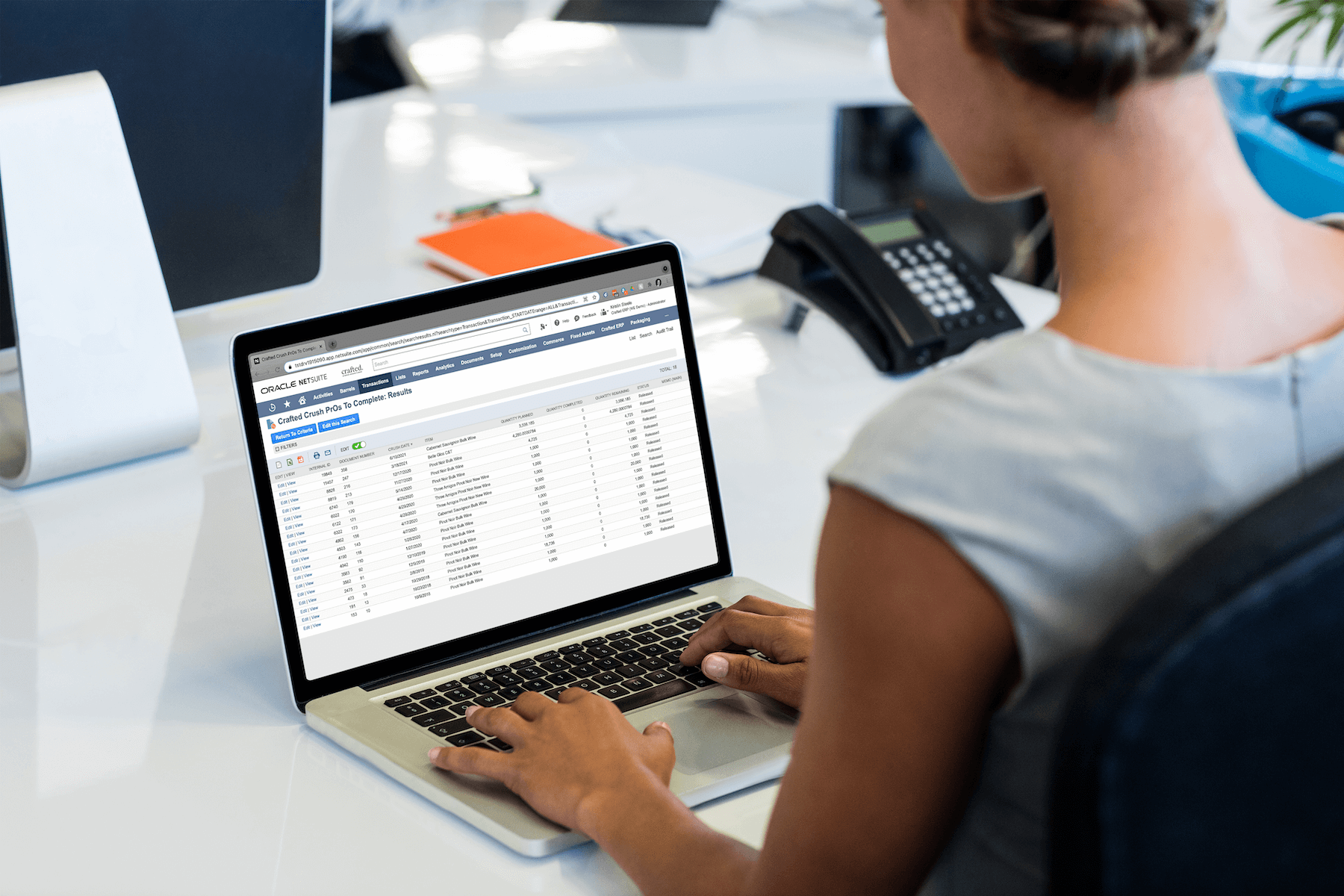

How can Crafted ERP help breweries navigate market contraction? Crafted provides breweries with real-time cost tracking, financial clarity and the operational control they need to survive contraction and plan for growth.

Stronger operations start here. Let’s build a system worthy of your beer. Ready to see the difference? Let’s chat.