Revenue is up 30% year-over-year. Your production floor is running at capacity. Sales just closed three new distribution deals. So why aren’t your margins improving?

Cross-category production is transforming the beverage industry. Breweries are expanding into spirits. Wineries are launching RTD lines. Distilleries are adding non-alcoholic options. But here’s the problem: most producers still track costs the same way they did when they only made one type of product. Effective multi-category cost tracking requires a fundamentally different approach.

That IPA you’re selling for $12 a four-pack? It might be profitable. That barrel-aged bourbon everyone loves? Maybe breaking even. The canned cocktail flying off shelves? You could be losing money on every case.

Without unified multi-category cost tracking, you can’t answer the most important question in your business: which products actually make money?

Disconnected systems, category-specific spreadsheets and manual reconciliations don’t just slow you down. They hide the truth about your profitability until it’s too late to course-correct.

Why Multi-Category Cost Tracking Plays by Different Rules

Comparing a hazy IPA, a barrel-aged whiskey and a canned cocktail isn’t apples to apples. It’s apples to barley to botanicals. Each category has its own economic DNA.

Analyzing them side by side without a unified system is like comparing a fermenter to a still. Technically possible, but practically meaningless.

Each category has its own cost structure, making direct comparison nearly impossible without a unified system:

- Raw materials follow completely different pricing models. Malt and hops behave differently than molasses and botanicals, which behave differently than grapes and fruit concentrates.

- Labor requirements vary dramatically. A distillation run demands different skills and timelines than a brew day or a crush season.

- Equipment utilization becomes murky when assets serve multiple categories. How do you allocate the cost of shared fermentation tanks, bottling lines or warehouse space?

- Packaging costs vary by format. Glass bottles, aluminum cans, bag-in-box or kegs each have different cost structures and margin implications.

- Storage and aging timelines range from immediate turnaround to multi-year maturation. That capital tied up in barrels isn’t free.

- Compliance and tax obligations differ by category. Beer excise tax rates don’t match spirits rates, which don’t match wine rates — and that’s before state-level variations.

- Distribution economics change by product type and channel. What works for kegs doesn’t work for bottles, and direct-to-consumer margins look nothing like distributor margins.

Most producers juggle this complexity by using separate systems: brewery software for beer, spreadsheets for RTDs, and a different platform for spirits. That patchwork approach hides visibility into true profitability and makes cross-category comparison impossible.

When You Can’t See Costs Clearly, You Can’t See the Truth

Cost chaos doesn’t announce itself. It starts quietly — a missed cost allocation here, an outdated spreadsheet there. Then those small inaccuracies snowball into major financial blind spots.

Disconnected systems distort profitability and delay response times. Imagine discovering your highest-revenue product is actually your lowest-margin one, months too late to course-correct. Unprofitable products start eating up working capital that could have funded your next innovation. Overproduction ties up inventory, underproduction frustrates customers, and forecasting turns reactive instead of strategic.

By the time leadership catches on, the problem isn’t just pricing. Its performance across the entire operation. Let’s break it down.

Financial impact hits first.

You’re underpricing products that should command higher margins, and you’re overproducing low-margin SKUs because the data says they’re popular, not profitable. Overhead allocations go missing entirely. Cash gets tied up in slow-moving inventory you shouldn’t have made in the first place.

Strategic blind spots follow.

Leadership can’t get clear answers to basic questions like “which categories and SKUs actually make money?” You miss growth opportunities because you’re investing in the wrong products. Competitors gain ground while you’re stuck analyzing incomplete data. When costs shift — and they always do — you lack the agility to respond quickly.

Operational misalignment spreads throughout the business.

Production plans prioritize volume over margin, while supply chain decisions optimize for the wrong metrics. Sales teams push “fan favorites” that barely break even, while marketing campaigns promote products with razor-thin profit margins. Everyone works hard, but not everything works toward profitability.

Our survey of brewery and distillery leaders confirms this isn’t an isolated problem. More than half of respondents (51%) report using four or more software systems to manage production, inventory, compliance and financials. The result is lost time, manual reconciliations and growing frustration. Businesses running six or more systems reported critical inefficiencies, including redundant data entry, automation gaps and costly errors that stall growth.

That’s the compounding effect of inaccurate cost tracking. It doesn’t break your business overnight. It erodes it over time — quietly, consistently and completely avoidable with the right system in place.

Real-Time COGS: The Foundation of Profitable Diversification

Now for the good news. You can stop guessing and start making better business decisions with comprehensive, actionable data.

The survey also revealed a clear pattern. Companies operating on fewer than three integrated systems reported less frustration, cleaner financials and greater confidence when expanding into new product lines. The takeaway? The more connected your technology, the more control you have over your costs and the faster you can make profitable decisions…in real time.

Real-time, multi-category cost tracking gives producers instant clarity. It’s not just about seeing numbers. It’s about seeing the truth.

Here’s what it delivers:

- Continuous visibility into profitability by SKU and category

- Automated cost calculations that update as production happens

- Margin analysis by product, customer and channel

- Alerts for cost spikes before margins erode

- A consistent methodology across all categories and products

No more waiting for quarter-end reconciliations or playing Excel detective. You get live cost insights so every decision is based on reality, not retrospective data.

Category-Specific Insight, Unified Data Power

COGS for whiskey doesn’t look like COGS for cider or seltzer. Multi-category cost tracking in a unified ERP lets you finally compare profitability apples-to-apples.

That means tracking:

- Raw materials by product type

- Production and aging time from start to sale

- Packaging and shipping costs per format

- Cold storage and overhead allocation

- Compliance, marketing and sales costs tied to actual revenue contribution

The payoff is complete financial clarity across your entire beverage ecosystem.

Turn Cost Chaos Into Cost Control

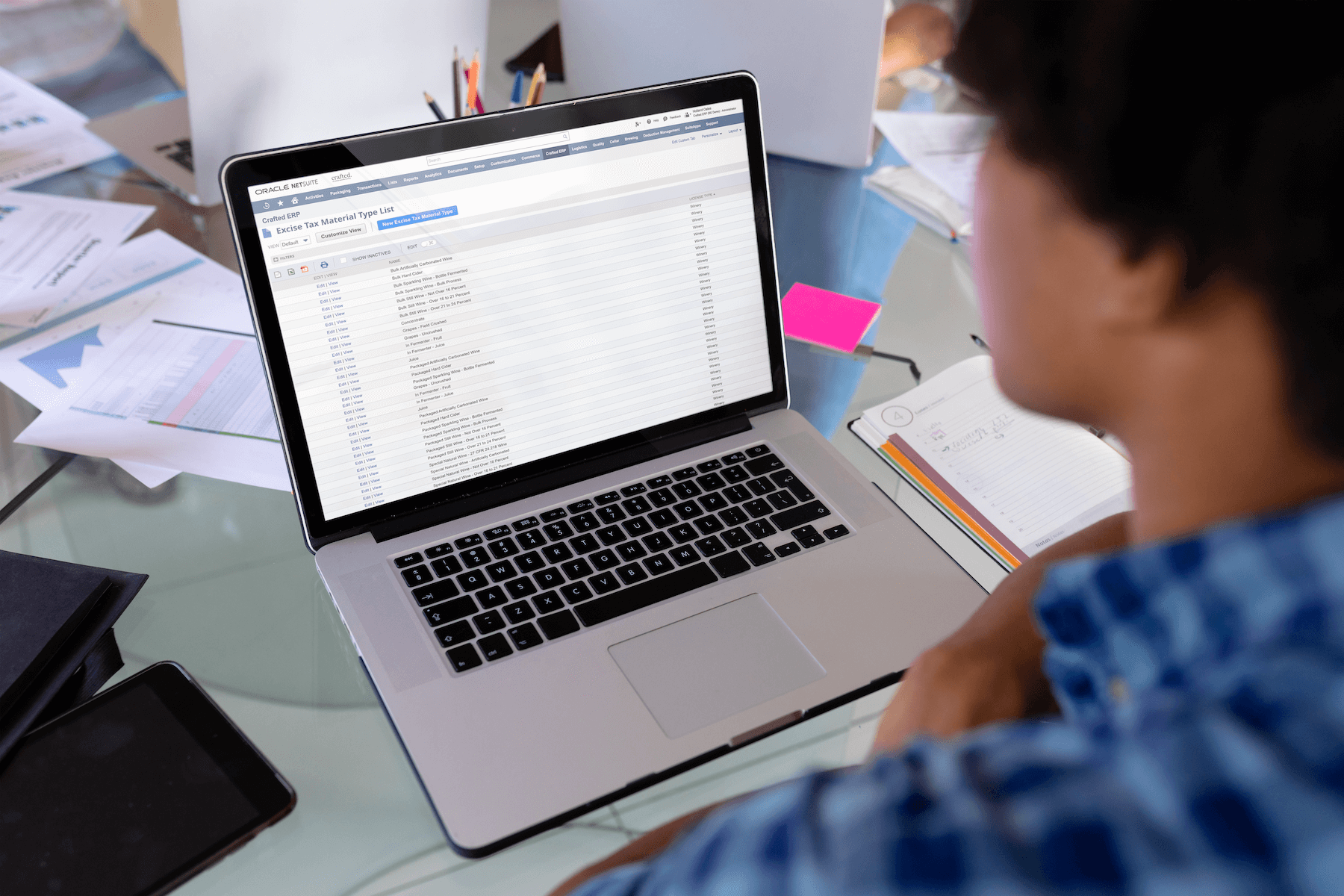

Imagine this dashboard moment: one screen, all categories, real-time profit clarity.

- You see which SKUs pull the most margin.

- You catch cost creep before it eats your bottom line.

- You plan production around profitability, not just demand.

- You walk into board meetings with answers, not assumptions.

Is beer paying the bills, or is your RTD line driving higher margins? Which SKU is outperforming the other — your gin or your lager? You can’t answer those questions without unified data.

So, how do you fix it? It’s not complicated. It requires the right system and a clear plan.

- Start with an honest assessment. Audit your current setup. List every tool that touches cost data — production software, accounting systems, spreadsheets, compliance platforms, etc. If they don’t connect, you’ve found your problem.

- Put a number to the problem. How many hours go into monthly reconciliations? How often do decisions stall because you lack real-time data? How many quarters have you missed margin targets? These aren’t just inefficiencies — they’re measurable profit leaks.

- Define what “good” looks like for your operation. What does success look like? Real-time, SKU-level margin visibility? Multi-category cost tracking in a single dashboard? Automated overhead allocation? Get specific about what you need to manage profitably.

- Choose technology built for beverage, not adapted for it. Generic ERPs weren’t designed for barrel tracking, TTB compliance and multi-category production. You need a platform that understands your business from the ground up — one that delivers real-time COGS automation, category-specific intelligence, multi-entity management, and drill-down reporting that scales as you grow.

Fixing the problem eliminates the noise, connects the dots, and gets your data to tell the truth.

Know More. Earn More.

In a market where everyone’s diversifying, the winners won’t be the producers with the most SKUs. They’ll be the ones who know exactly which SKUs drive profit.

Crafted ERP BevX is the only ERP built specifically for multi-category beverage producers. It unifies your costs, compliance and cash flow in one platform — giving you the real-time visibility to make confident decisions about every product you make.

Because growth without profitability isn’t growth, it’s just noise.

See what your portfolio is really worth. Schedule a demo.