You see the headline nearly every week: X Brewery is merging with (being acquired by, buying, etc.) Y Brewery. It’s in the news so much these days that it’s not really news.

But what’s driving all of this brewery M&A activity? It’s possibly the need for more capital to buy new equipment, an owner or founder planning an exit, or maybe it’s realizing that sometimes strength in numbers really is the key to success.

Whatever the motivation, preparing for a merger or acquisition in the craft beer world is like brewing the perfect batch — it requires the right ingredients, precise timing and a solid understanding of what could go catastrophically wrong.

The good news? Unlike that experimental pumpkin-jalapeño porter that shall never be spoken of again, this process is actually repeatable and predictable when you follow the right steps.

Whether you’re looking to expand your market reach, introduce innovative products, or simply want someone else to worry about quarterly taxes, these four critical steps will help ensure your brewery M&A deal doesn’t become a cautionary tale whispered about at CBC.

Step 1: Assess Your Financial Health to Prepare for Brewery M&A

Understanding your brewery’s current financial status is the foundation of M&A readiness. Modern brewery financial software provides the comprehensive overview and actionable insights you need.

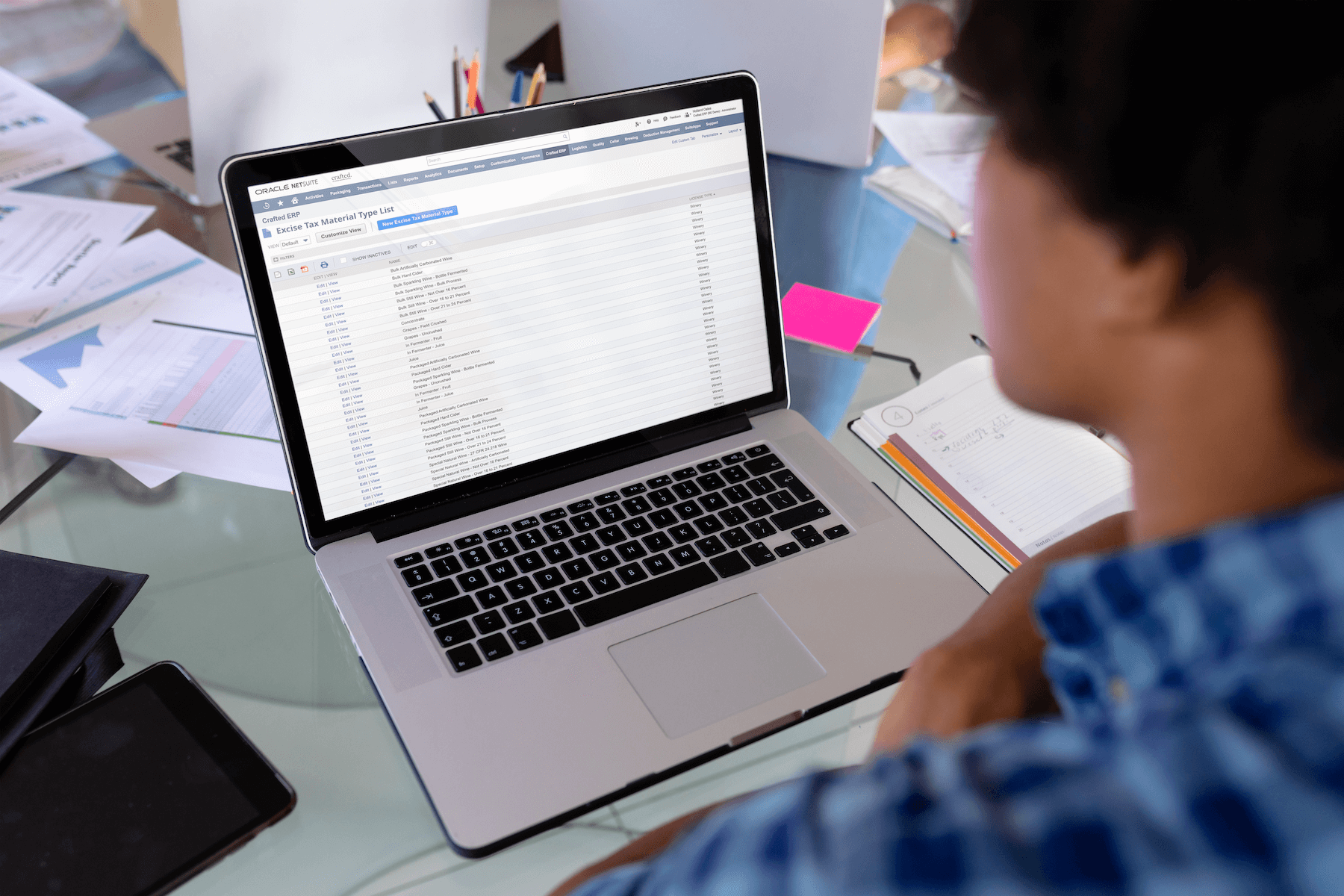

Brewery ERP can provide a holistic view of your operations. It can aggregate critical data on inventory, production costs and sales performance, allowing real-time monitoring of financial metrics. A centralized system can transform your decision-making process by providing instant access to crucial financial indicators.

Brewery ERP helps you prepare your finances for M&A by providing:

- Accurate financial reporting: Identify trends, compare forecasts to actual figures, and support evidence-based decision-making. Potential partners will scrutinize your financial documents closely, so maintaining impeccable records demonstrates professionalism and transparency.

- Precise costing: You can track costs at the batch level, showing exactly what each beer costs to produce including ingredients, labor, utilities and overhead. This granular cost visibility helps identify the most and least profitable products — crucial information for valuation discussions.

- Working capital analysis: Detailed tracking of accounts receivable, accounts payable and inventory levels helps establish working capital requirements and identify optimization opportunities.

- Competitive analysis: Financial planning tools help you understand how your brewery performs relative to industry peers. This external perspective ensures you’re financially prepared for negotiations and helps establish realistic valuation expectations.

- Multi-year financial history: ERP systems maintain detailed historical data that shows financial trends over time, helping potential partners understand your brewery’s seasonal patterns, growth trajectories and operational consistency.

The reality is that breweries with solid ERP-generated financials close M&A deals faster, at higher valuations, and with fewer complications. It’s the difference between looking like a sophisticated business operation or a hobby you started on a whim.

Step 2: Modernize Operations for Maximum Efficiency

The beverage industry is driven by evolving consumer preferences and technological advancements. Aligning your operations with forward-thinking strategies demonstrates value to potential partners and showcases your brewery’s commitment to excellence.

ERP software integrates all business processes across departments to enhance operational efficiency ahead of brewery M&A discussions. It enables all departments to work from the same real-time data, helping you pinpoint bottlenecks or waste that affect your bottom line.

Operational excellence is a significant asset that can increase your valuation, and even small gains in efficiency can translate to notable increases in profitability and attractiveness to potential partners.

Brewery ERP software helps you enhance operational efficiency by:

- Optimizing supply chain management: With specialized ingredients, equipment and time-sensitive production schedules, even minor interruptions can significantly impact profitability. Developing agile supply chains demonstrates foresight and operational resilience, enabling you to mitigate risks that could derail production schedules.

- Visualizing production scheduling: ERP software automatically schedules production runs based on demand forecasts, ingredient availability and equipment capacity. It can help optimize batch sizes, minimize changeover times, and ensure you’re brewing the right products at the right time to meet customer demand without overproducing.

- Managing batch & lot traceability: Complete traceability from raw materials through finished products becomes automatic, which is crucial for both quality control and regulatory compliance. You can quickly track any ingredient or batch through the entire production process.

- Automating reporting & analytics: Instead of spending hours manually compiling reports, brewery ERP generates real-time dashboards and analytics. You can instantly see production efficiency metrics, cost per batch, inventory turnover rates, and profitability by product line.

A brewery that operates like a well-oiled, unified machine rather than separate departments trying to coordinate through email and sticky notes is more valuable to potential partners. If you’re looking to structure a brewery M&A deal, ERP software can be the catalyst for a successful and lucrative contract.

Step 3: Strengthen Your Market Position & Brand Strategy

A deep understanding of your market position is crucial for maximizing valuation during a brewery M&A deal. The difference in deal terms can be enormous — sometimes 2-3x higher — for breweries with substantial brand equity versus those struggling in the market.

A brewery with a clear brand identity and strong market position represents a more attractive acquisition target. The goal is to have potential partners say, “We need to own this successful brand before our competitors do,” rather than “We can save this struggling brewery.”

You can strengthen your brand for a brewery M&A deal by:

- Analyzing market trends & consumer preferences: Understanding what your customers want helps you not only adapt to changes but also anticipate and drive them. For example, recognizing the growth potential of low-ABV or non-alcoholic options could lead to the development of new products that become bestsellers. Use customer and market data to identify emerging niches where your brewery could establish leadership before competitors recognize the opportunity.

- Leaning into your differentiators: Do your customers love regional-inspired brews made with local ingredients? Is there a unique flavor profile that would distinguish you from your competitors? Appeal to your customers’ sentiment and lean into what makes your brewery unique and memorable.

- Building a strong digital presence: Craft a compelling brand story that resonates with your target audience. Leverage social media platforms and your website to showcase your brewery’s unique culture, brewing philosophy and community engagement. These digital assets become valuable components of your overall brand equity during valuation discussions.

Potential brewery M&A partners look for businesses that have long-term value and a strong market position. When your brand story forms a deep connection with your community, it creates a built-in, reliable customer base that will continue to support the brewery regardless of any changes ahead.

Step 4: Prepare for Legal and Regulatory Compliance

Brewery M&A involves complex legal and regulatory considerations that require careful navigation. A brewery with well-documented compliance practices represents lower risk and fewer complications during the due diligence process.

You must understand the full implications of potential transactions before proceeding with brewery M&A. Work with an experienced legal team to review possible business impacts, such as trademark concerns that could result in costly penalties. Conduct a thorough audit of all intellectual property assets, including beer names, logos and marketing materials, to identify any potential conflicts or registration gaps.

Breweries preparing for M&A can leverage ERP software to:

- Ensure regulatory compliance: Brewery compliance rules can differ significantly by state and country, creating a complex compliance landscape. ERP software helps you manage these diverse requirements, demonstrating organizational maturity and efficiency. Document your compliance processes meticulously, as potential partners will scrutinize these areas closely during the due diligence process.

- Automate record-keeping: ERP systems automatically generate and maintain the extensive records required by the TTB, state agencies and other governing bodies. This includes production reports, inventory tracking, excise tax calculations and label approvals — all stored in auditable formats.

- Prepare tax calculations: Brewery ERP can help your team easily calculate federal excise taxes, state taxes and local taxes based on production volumes and distribution locations. This will help you reduce compliance errors and ensure your filings are accurate.

- Create an audit trail: Every transaction, from ingredient purchases to finished product sales, creates an immutable audit trail that the TTB and other regulatory organizations can easily review during inspections.

It’s essential during any brewery M&A deal to review all employment practices and business contracts and ensure all documentation is current and compliant with applicable laws. Review employee agreements, distribution contracts, property leases and equipment financing arrangements to determine if any clauses would be triggered in the event of a change in ownership.

The Path to Successful Brewery M&A

The brewery M&A process isn’t just about making your business attractive to potential partners — it’s about building a stronger, more resilient operation regardless of the outcome. By focusing on financial health, operational efficiency, market position, and legal and compliance practices, you’re creating a brewery that’s well-positioned for long-term success.

The craft beer industry continues to evolve. Breweries that embrace technology, diversify their product lines, and adopt innovative approaches will find themselves well-prepared for whatever the future holds — whether that’s continued independent growth or a strategic partnership through merger or acquisition.

Beginning this preparation process early gives you more control over the outcome. Rather than rushing to address concerns raised during due diligence, you’ll be negotiating from a position of strength with a clear understanding of your brewery’s value. This proactive approach facilitates smoother transactions and often results in more favorable terms.

By implementing these four essential steps, you can ensure your brewery operates at its highest potential every day. The journey toward brewery M&A readiness is ultimately a journey toward operational excellence — a worthwhile destination regardless of your brewery’s eventual path.

Are you ready to take the first step toward brewery M&A readiness? Crafted ERP Brewery Edition can help you build a strong financial foundation with operational transparency that potential partners will value. Contact us today to discover how Crafted can help position your brewery for success, whether you’re planning for growth, exploring a strategic partnership, or seeking to operate more efficiently.