There’s nothing “cheap” about going alcohol-free. While consumers often expect non-alcoholic drinks to cost less, producers know removing or avoiding alcohol doesn’t negate complexity. It adds it.

Every step in NA production, from dealcoholization to quality control, introduces new costs that traditional alcoholic beverage makers typically don’t face. Yet many brands still price their products by instinct, not insight.

Without precise visibility into true production costs, even the most innovative brewers and distillers can end up subsidizing their NA SKUs instead of profiting from them.

What’s Driving NA Beverage Pricing?

NA production introduces cost layers that traditional alcoholic beverage makers don’t face:

- Technology: Dealcoholization equipment (reverse osmosis, spinning-cone columns), arrested-ferment controls and pasteurization systems require significant capital investment and ongoing maintenance.

- Ingredients: Producers must source premium botanicals, balancing acids, functional additives and aroma capture compounds to rebuild flavor profiles stripped during dealcoholization.

- Labor & QA: Each batch demands additional production steps, sensory evaluation panels, microbiological testing, and more frequent line cleaning protocols to maintain quality without alcohol’s natural preservative properties.

- Shrink & Variance: NA batches yield less usable product due to smaller production runs, higher waste during flavor refinement trials, and increased spoilage risk in draught systems where alcohol’s antimicrobial properties no longer protect the beverage.

- Education & GTM: Brands shoulder the cost of consumer sampling programs, staff and menu training, and navigating dual-placement challenges between the beer aisle and wellness section.

By illuminating real costs at the ingredient, batch and channel levels, producers can defend premium pricing with confidence and build sustainable margins in a fast-growing but margin-sensitive category.

Why Alcohol-Free Isn’t Cheap

For a category that started as an “alternative,” NA beverages now represent a multi-billion-dollar global market. They are growing fast, with U.S. sales up 22% year-over-year, according to NielsenIQ.

But the science behind that success is costly. Producing alcohol-free drinks often means making alcohol first and then removing it. Techniques such as vacuum distillation, spinning cone technology and reverse osmosis require high-end equipment, energy and expertise.

Even global leaders like Athletic Brewing rely on proprietary processes to prevent ethanol formation entirely, investing heavily in R&D to replicate full-flavor fermentation without the buzz. These extra steps lengthen production cycles and reduce economies of scale, driving up the per-unit cost.

And it’s not just process. It’s risk. Smaller batch sizes mean higher unit costs, while each production run carries greater waste potential. Dealcoholization can also degrade volatile compounds, like esters and terpenes that give beverages their aroma and flavor, forcing producers to spend more on flavor restoration or blending.

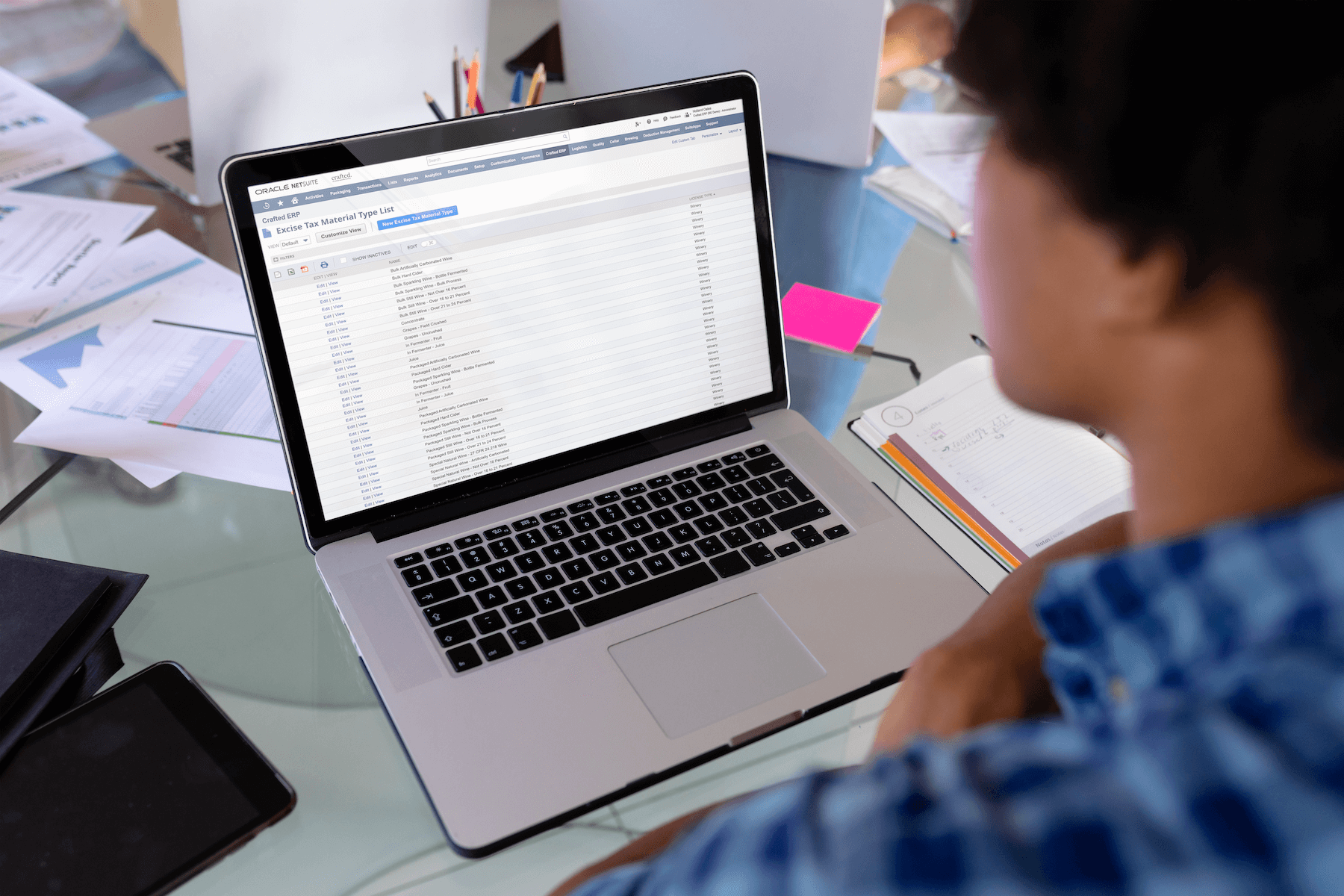

How ERP helps: With batch-level cost tracking, beverage ERP systems like Crafted expose hidden inefficiencies in NA production. By tracking every ingredient, machine hour and QC step in real time, producers can see exactly which SKUs are profitable and, conversely, which ones are quietly draining resources.

Premium Ingredients, Premium Costs

If alcohol-free is the new luxury, it’s because the ingredients demand it. To mimic alcohol’s body and warmth, producers rely on natural flavor systems, glycerin, botanical distillates and functional ingredients like adaptogens or nootropics, all of which carry premium price tags.

Many NA spirits cost more per milliliter than their alcoholic counterparts, with bottles running $20–$30 for 500 ml, compared to $18–$35 for a full 750 ml of spirits. These costs multiply when brands pursue organic or clean-label certifications or add vitamins and botanical extracts to align with wellness-driven consumer trends.

How ERP helps: Ingredient costs can swing sharply month-to-month, especially in a tariff-driven market. ERP systems with real-time supplier cost tracking and recipe management let producers model how every ingredient change affects batch cost before committing to production. That means fewer surprises on the P&L and faster, data-backed NA beverage pricing adjustments when supplier prices rise.

Quality Control: No Room for Error

Hopefully, you like your NA drink with a twist because the less alcohol a product has, the more scrutiny it gets. Alcohol is antimicrobial, a preservative and a flavor stabilizer. Without it, NA beverages face higher spoilage and contamination risks, especially on draft systems.

A 2023 Cornell University study found that pathogens like E. coli and Salmonella can survive and multiply in NA beer, leading the Brewers Association to issue cautious guidance about NA draft safety. Maintaining microbiological integrity requires rigorous cleaning, shorter keg life, and costly pasteurization or filtration steps.

Meanwhile, consumers expect NA drinks to taste the same, or very close to, their alcoholic counterparts. But with NA, there’s no ethanol to mask off-flavors, so even slight inconsistencies in fermentation, blending or pH can ruin an entire batch. Many NA producers invest in sensory panels, additional QC checkpoints and lab testing to maintain flavor stability.

How ERP helps: ERP-integrated quality control modules track every test, variance and rejection cost in one place. When quality perfectionism starts eating into profit, cost-linked QC data helps producers pinpoint where quality adds value and where it adds cost.

Getting to Market is Expensive, Too

Even after production, costs continue to mount. NA producers often face education costs to earn shelf space and consumer understanding. From sampling programs to category storytelling, every pour costs money. Premium glassware, branded collateral and digital marketing campaigns all add to overhead.

Retail placement also matters. Should NA beer sit beside alcoholic versions or in the functional beverage aisle? Most retailers still experiment, so brands shoulder dual-channel distribution, maintaining relationships with both alcohol and grocery distributors.

Then there’s margin math. On-premise, a well-made mocktail might fetch $10–$12, but its margin barely beats that of a $6 cocktail due to ingredient and labor costs. Meanwhile, wholesale margins on packaged NA beer can lag because of limited economies of scale.

How ERP helps: ERP-driven channel profitability reports reveal where to push and pause. Crafted lets producers compare margins by SKU, channel and customer type, showing whether direct-to-consumer, taproom or retail truly moves the needle.

NA Beverage Pricing Strategy for Sustainable Growth

Premium pricing is math, not marketing. The economics of NA beverage production demand it. What looks simple on a shelf hides layers of cost and compliance that would make any CFO blink.

Why NA Beverage Pricing Needs a Different Playbook

Unlike traditional beer, NA beverages fall under a different set of rules. Once alcohol-free products exceed 5 % of total output, they’re regulated as food, not alcohol, triggering the FDA’s Hazard Analysis Risk-Based Preventive Controls (21 C.F.R. §117) requirements.

Each line item adds cost and credibility. NA producers must replace traditional alcoholic defenses with testing, pasteurization and hazard controls that raise both cost and confidence.

That shift comes with higher expectations and heavier overhead:

- Specialized food-safety programs and extra QA and microbiological testing per batch to manage microbial risk

- Additional permits from state and local agencies

- Frequent cleaning intervals for draught and packaging lines to prevent contamination

- Capital investment in pasteurization or tunnel heat systems

- Training and documentation to meet FDA and HACCP audit standards

These layers safeguard consumers and shape your NA beverage pricing.

Best Practices for Pricing with Precision

To keep growth sustainable and margins intact:

- Calculate true COGS to include overhead, compliance and testing costs

- Set minimum margin thresholds per category (NA beer vs. NA spirits vs. zero-proof or functional beverages)

- Schedule routine pricing reviews tied to ingredient and regulatory cost shifts

- Model compliance overhead in every SKU forecast

- Lead with transparency — retailers respect numbers more than narratives

NA Beverage Pricing: Ways Cost Management is Better with ERP

Knowing your costs is one thing; proving them is another. That’s where ERP earns its place.

Cost Tracking

- Without ERP: Manual spreadsheets lag weeks behind production changes, leaving you managing costs with outdated information.

- With Crafted: Automated COGS tracking updates in real time to capture ingredient, labor and compliance costs as they happen.

Compliance Documentation

- Without ERP: Compliance documentation is scattered across disconnected files, turning audit prep into a scramble.

- With Crafted: Centralized regulatory reporting compiles audit-ready FDA and TTB data in minutes.

Batch-Level Visibility

- Without ERP: Batch-level costs for QA, sanitation and waste disappear into averages, hiding where money actually goes.

- With Crafted: Batch-level variance analysis pinpoints actual production costs and efficiency gains per run.

Ingredient Price Management

- Without ERP: Supplier price changes go unnoticed until invoices arrive, and margins quietly erode.

- With Crafted: Recipe management instantly recalculates COGS when ingredient or packaging prices shift.

Margin Intelligence

- Without ERP: No clear margin visibility across SKUs, channels or customers means you’re flying blind on profitability.

- With Crafted: Margin dashboards show profitability by product, channel and customer in a consolidated view.

Pricing Strategy

- Without ERP: Pricing decisions rely on guesswork and gut instinct.

- With Crafted: Scenario planning tools model “what-if” price and margin outcomes before production begins.

When you move from spreadsheets to real-time ERP, you stop managing costs in the rearview mirror. You start steering with precision.

Athletic Brewing discovered that when it implemented Crafted. “Crafted ERP gave us granular cost visibility across SKUs and cut our month-end close time by 10–15%,” shared Controller Jillian Moccia. What used to take detective work now happens in real time, lifting the financial fog.

Crafted connects every cost element — from recipe tweaks to regulatory testing — and calculates your true COGS automatically, so your next pricing decision drives growth instead of guesswork.

No Alcohol. Full Cost Control.

Non-alcoholic doesn’t mean low-value. It means high precision. The brands winning this category, from Athletic Brewing to Ritual Zero Proof to Seedlip, master both craftsmanship and cost control.

As the category matures, the gap will widen between businesses that track costs in real time and those that guess. In a market where shelf space, ingredients and consumer attention all carry premiums, ERP is essential.

Cost leaders will define the future of the NA category. Your margins know the truth. ERP makes it visible.

Stop guessing, start proving. Crafted ERP’s Non-Alc Edition shows exactly where your profits pour from, and where they leak. Ready to stop the leak?