Ask any investor what they want from a beverage CFO, and the answer is simple: confidence. Real numbers, right now. No caveats, no 30-day delays, no “we’ll circle back once the books are closed.”

But in the beverage business, confidence is tough to deliver when cash is tied up in barrels, compliance is manual, and entities are spread across disconnected systems. Inventory ages for years before it sells. Excise taxes and TTB reports pile up. COGS is a moving target. Predicting liquidity can feel more like fortune-telling than forecasting.

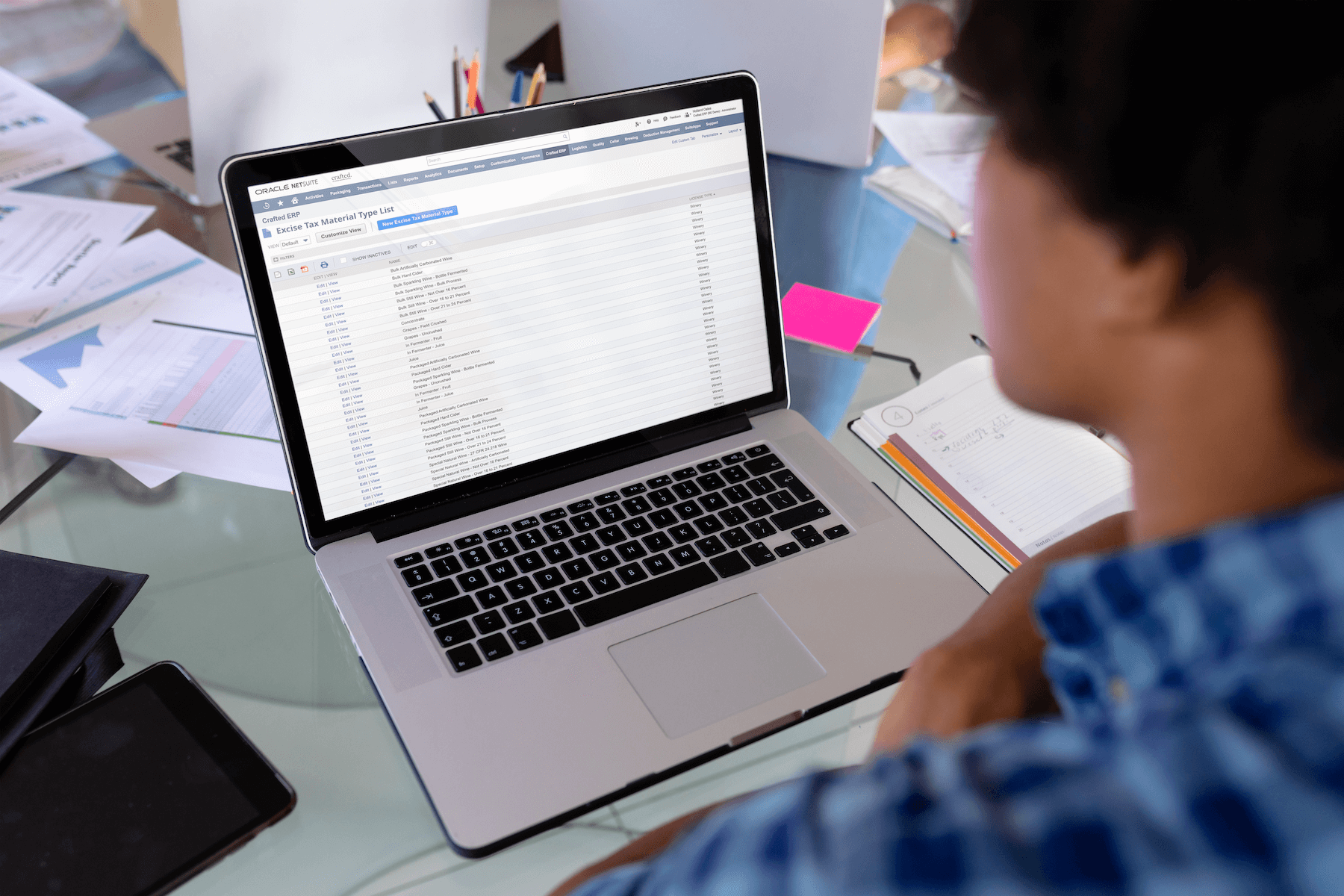

That’s the cost of running finance on tools never built for the beverage industry. Modern CFOs are demonstrating that — with the right systems — finance can transition from firefighting to strategic control. Beverage-native ERP isn’t just about accounting efficiency. It’s about real-time visibility, compliance confidence and financial precision that drives growth.

Financial Blind Spots That Thwart Growth

Every beverage CFO knows the pain of “Excel Olympics.” When finance depends on manual roll-ups, siloed systems or outdated reports, the blind spots multiply. And those blind spots carry a heavy cost.

- Manual consolidation hell: Switching between QuickBooks, spreadsheets and standalone inventory tools wastes time and increases error risk.

- Delayed visibility: When financials lag 15–30 days behind operations, decisions are made in the dark.

- Compliance complexity: TTB reports, excise tax filings and state-by-state rules eat up valuable administrative hours every month.

- Inventory valuation headaches: Work-in-process, barrel aging and variable units of measure make accurate costing a moving target.

- Cash flow blindness: Without clear visibility into when tied-up inventory will turn into liquidity, financial planning becomes guesswork.

These operational annoyances delay fundraising, hide margin leaks and erode investor confidence. Blind spots cost opportunity, not just time.

Real-Time Visibility Across the Production Lifecycle

The beverage CFO role is shifting from reporting on what happened to steering what’s about to happen. That shift is impossible without real-time visibility.

With beverage-specific ERP, every step of the production lifecycle – from raw materials to WIP to finished goods – is connected. True COGS is visible as products move through the system, not weeks later. Cash conversion cycles can be tracked and modeled. CFO dashboards show the metrics that matter most: profitability by SKU, inventory turns and channel margins.

Case in point: Big Easy Blends. Operating five production facilities with eight filling lines running 24/7, complexity is the norm. For CFO Craig Cordes, real-time oversight is non-negotiable: “At any given time, I can see what’s in transit, what’s on hand, and what’s shipped. Most importantly, I can see it by lot. One of the big aspects of manufacturing today is traceability, and Crafted offers the ability to track, from start to finish, raw materials to finished goods seamlessly across multiple locations and multiple products.”

Dashboards have become his control center: “It’s faster, more collaborative and always up-to-date. I use it more than my email. Crafted is literally my control center.”

For beverage CFOs, that kind of command center changes decision-making while also saving time. Predictive cash flow models tied to real production data replace guesswork with confidence.

Automating Compliance Without Compromising Control

For many beverage CFOs, compliance is the tax on growth. TTB reports, excise filings and multi-state tax calculations eat hours every month, with zero tolerance for error. ERP changes the math:

- TTB reporting is automated and auditable.

- Multi-state taxes are calculated and filed seamlessly.

- Monthly compliance tasks run in the background, freeing finance teams for higher-value work.

- Built-in audit trails reduce risk and increase investor confidence.

Consider Long Meadow Ranch. With eight entities and multiple charts of accounts, VP of Finance Brett Pinkin describes the pre-ERP reality bluntly: “It was very painful, to say the least.” Reconciling across systems consumed resources and introduced risk.

With Crafted ERP, Long Meadow Ranch now runs 10 entities in one cloud platform: “We’re able to run all operations end-to-end, efficiently and in real time with Crafted ERP. It was the only solution that could address our needs holistically.”

The time savings are staggering. Reports that once took days now run in seconds. Compliance reporting time is dramatically reduced, and with integrated dashboards, financials can be presented investor-ready at any time.

Strategic Financial Management Tools for CFOs

Compliance and reporting are table stakes. The real value for CFOs comes in the strategic toolkit ERP unlocks.

- Scenario planning and modeling: Run what-if analyses on SKUs, pricing and channel strategy.

- Multi-entity consolidation: Eliminate manual roll-ups, speed close cycles, and deliver accurate consolidated statements.

- Investor-ready reporting: Build confidence with lenders, private equity and distribution partners through real-time visibility.

At Long Meadow Ranch, predictive visibility has become critical. Supply chain analyst Quinn Sheridan explains, “We produce products years before we sell them, so we need to make sure we’re getting good and accurate, actionable insights. By getting timely information from Crafted, we can adjust accordingly and act upon it.”

For beverage CFOs, that means forecasting cash flow with accuracy and making capital allocation decisions with confidence.

Two Beverage CFO Stories, One Clear Advantage

When finance leaders talk about transformation, the story is less about technology and more about outcomes: faster closes, cleaner audits and better decisions. Here’s how finance leaders describe the impact of Crafted ERP in their own words.

Implementation Without Disruption

Implementation is often the biggest fear for finance teams. At Big Easy Blends, CFO Craig Cordes expected implementation to take a week. Instead, it was live in a day and a half: “We expected the cutover to take a week. It took 36 hours. The Crafted team was hands-on, on-site and walked us through every step.”

ERP as the Control Center

Craig explains: “As the business continues to evolve, we continue to embrace technology to grow and streamline our business. Now the products we make in the physical world are reflected in real time in the digital world.” That integration has turned dashboards into decision-making tools, not just reports.

Multi-Entity Made Simple

At Long Meadow Ranch, the pain was multi-entity complexity. CFO Brett Pinkin recalls, “With eight unique entities, plus eight different charts of accounts, a team member had to log out of one and log into another, and so on. It was very painful…” For CFOs managing multiple subsidiaries, entity management can feel like death by a thousand logins. Crafted unified reporting across all entities, saving countless hours and reducing risk.

From Accounting to Action

When the books take care of themselves, finance leaders can focus on what’s next. Brett explains: “This helps us spend less time on the accounting and more time on our goals and what we need to do to reach them.” The measure of ERP success isn’t how fast the books close. It’s what finance leaders can do once they’re closed.

Different branches of the beverage industry, different structures. But the common denominator is clear: beverage CFOs win when they have real-time visibility and control.

From ERP ROI Promise to ROI Proof

Hearing success stories is inspiring, but beverage CFOs buy outcomes. Boards and investors will ask: What’s the ROI? How soon? What risks are we reducing?

ERP ROI can be measured through five pillars: labor efficiency, inventory optimization, compliance excellence, multi-entity synergy and competitive advantage. These aren’t abstract benefits. They show up as:

- Shorter close cycles, often cut by 10–15%

- 60–100 hours per month reclaimed from manual work

- Compliance reporting reduced by 75%

- Faster, more accurate consolidated financials

- Margin visibility down to SKU, channel or territory

Timeline That Matches Investor Expectations

ERP horror stories usually involve years-long deployments with uncertain payback. That’s not the Crafted model. Beverage CFOs, such as Craig Cordes, saw implementation completed in 36 hours, with dashboards delivering value immediately. Across the board, customers report material ROI within 12 months, fast enough to satisfy even the most ROI-driven investors.

Risk Reduction That Resonates

For finance, risk management is as important as return. Automated TTB reporting, audit trails and multi-state tax compliance not only free up time but also reduce exposure. Investors see less regulatory risk, auditors see cleaner books, and CFOs sleep easier.

Strategic Agility for What’s Next

ROI isn’t only about today’s efficiency. ERP builds the financial infrastructure to support acquisitions, brand launches and market expansion. It’s the system you take into investor meetings as proof you’re scalable and future-ready.

When finance leaders make the case to their boards or investor groups, the conversation shifts from “how much does it cost?” to “how fast will it pay back?” With Crafted, the answer is measured in months, not years.

When Finance Leads, Growth Follows

Finance teams reclaim time, compliance becomes a strength, and visibility extends from barrels in bond to the boardroom. In three to five years, this is the difference between struggling to keep pace and running investor-ready operations that scale with clarity.

Implementation doesn’t have to be disruptive; many beverage CFOs who engage Crafted succeed with a phased “crawl, walk, run” approach that builds confidence step by step. Change management is critical, but with embedded workflows, super-user training and Hypercare support, adoption sticks.

Your next close could be faster, cleaner and investor-ready. Schedule your executive session now.