California’s new bottle bill, the California Beverage Container Recycling and Litter Reduction Act, is shaking up the wine and spirits industry in the state. Launched in January 2024, the act requires upgraded bottle labels, mandatory recycling, bottle refunds and corresponding paperwork, significantly impacting producers in terms of operations and compliance.

While some California wine and spirits producers may find parts of it challenging, such as labeling, payments and reporting, there are some key strategies to help mitigate the common compliance headaches. Let’s examine how to manage these changes and find efficient ways to handle compliance and sustainability.

Uncorking the New California Bottle Bill

SB 1013 brought one of the most significant changes for California wine and spirits producers since the end of Prohibition. While it’s been talked about in length far in advance, many producers appeared unaware or unprepared, or both, for the new regulations.

The bill requires upgraded labels for all wine and spirits bottles, mandatory recycling, bottle refunds and the paperwork tied to these processes, which impacts any wine and spirits producer that sells products in California. (Whether the company is located in California or not!)

To better understand the complexities of this bill, let’s dive into some key details.

- All producers, third-party bottlers, and distributors must register with CalRecycle, the state agency in charge of administering the recycling program. One registration is required for each federal tax identification number used.

- Wine and spirits producers are responsible for modifying their bottle labels before the July 1, 2025 deadline. These labels must include state identification and recycle value messaging.

- Mandatory reports must be filed on the 10th of each month, and annual reports are required on all fees paid and processed through the recycling program. For California wine and spirits manufacturers, data on how many bottles were produced for consumption that month is also required.

- The required fees associated with the new recycling bill depend on how a company is registered. California wine and spirits producers and any company selling wine or spirits in the state pay processing fees. Distributors are required to pay the CRV redemption fees, which ultimately go back to consumers.

There’s a lot more involved, and it’s critical for any company involved in the industry to take time to comprehend and adapt to these changes.

Common Compliance Issues and How to Avoid Them

As with any significant regulatory change, compliance issues are inevitable. But by understanding some common ones, California wine and spirits producers can proactively mitigate them:

- Lack of awareness: A primary compliance issue is unawareness of the new bill. Wine and spirits producers must actively seek information on new regulatory changes affecting their industry.

- New labeling regulations: Compliance with the new labeling regulations will require major changes, given the specific requirement for updated labels with every bottle, necessitating a complete redesign for some.

- Recycling requirements: The mandatory recycling requirement may pose significant logistical and procedural challenges for wineries and distilleries, particularly those with high output volumes.

- Payment responsibilities: The per-container refund value represents an additional cost that producers, distributors and wholesalers must account for in the supply chain.

- Preparation for registration: All industry players, no matter their capacity, must understand the differences between classifications to properly prepare and register with CalRecycle.

To avoid any compliance issues, California wine and spirits producers should do their due diligence, stay alert to news and updates, and proactively plan for any adjustments to operations. It’s also important for producers to be in constant contact with their wholesalers, who could be helpful resources given their stronger capacity to handle changes required by the bottle bill.

Clear Solutions for Managing Compliance and Fostering Sustainability

Whether well-versed in all the requirements or in the early stages of discovery, California wine and spirits producers have a beacon of hope to effectively manage compliance and nurture more sustainable practices. Enterprise resource planning (ERP) solutions present a multitude of benefits for wineries and distilleries, particularly in dealing with regulatory changes:

- Regulatory compliance: Aggregated data, customizable dashboards and built-in reporting capabilities help businesses remain compliant when addressing new regulations and laws.

- Resource management: Beverage ERP systems help streamline and automate processes, making it easier for producers to manage resources more efficiently.

- Cost-effectiveness: By automating many procedural tasks, ERP systems can reduce overhead costs, free up staff to focus on critical business operations and potentially decrease errors that could attract fines.

Key Features of ERP Systems for California Bottle Bill Compliance

ERP systems can be equipped with particular features that aid in managing compliance with the California Bottle Bill:

- Inventory management: California wineries and distilleries are required to report the number of bottles produced each month, so real-time inventory tracking enables producers to quickly account for each product made.

- Reporting tools: Comprehensive reporting tools allow California producers to report up-to-date information to CalRecycle and other necessary parties. Wineries and distilleries can easily manage registration, financial reporting and other paperwork related to compliance with the bottle bill.

- Label management: Some ERP systems come with label management features, enabling producers to efficiently create and store label designs that meet all the new regulations.

ERP solutions built specifically for the wine and spirits industry could be the secret weapon for California’s wine and spirits producers seeking quicker, more efficient ways to adapt to the new bottle bill, while also fostering more sustainable practices.

Top Shelf Solutions for California Producers

The introduction of California’s new bottle bill represents a significant regulatory shift for the state’s wine and spirits industry. Due to the newly implemented requirements for upgraded labeling, mandatory recycling, bottle refunds and documentation, California wine and spirits producers will have to adapt operations and adopt new tools to avoid common compliance issues.

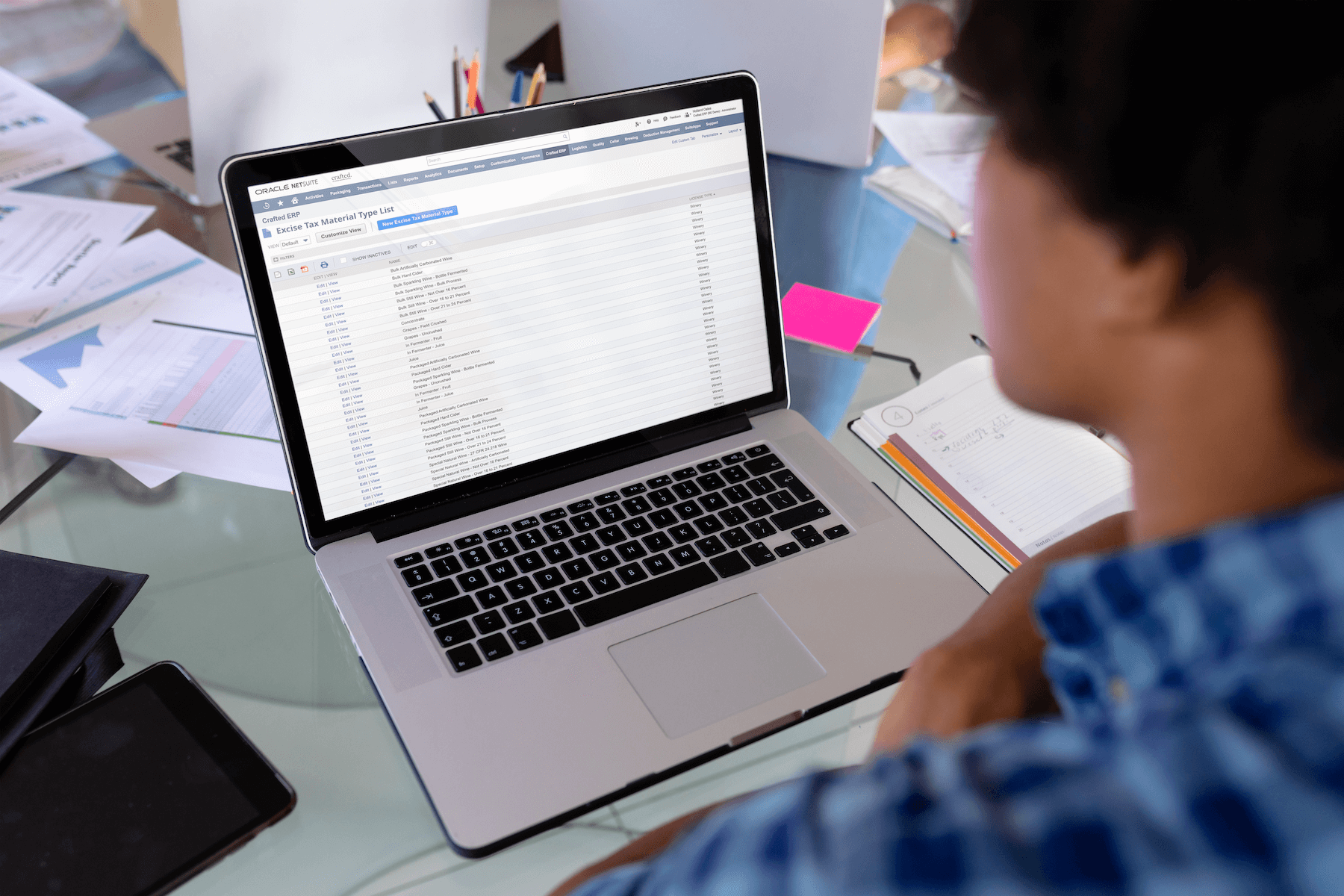

Crafted ERP, which can manage all aspects of winemaking and craft spirits production in a single system, offers category-specific tools to handle the new regulatory changes effectively. All production, packaging, labeling and inventory tracking seamlessly integrates with financial data, sales orders and federal and state compliance reporting. No other software solution on the market comes with more out-of-the-box features necessary for California producers to meet all the requirements of SB 1013. Crafted even includes sustainability tools enabling California wine and spirits producers to aggregate data on energy use, water consumption, trash and CO2 emissions.

If your wine or craft spirits business is struggling to maneuver through the new California recycling requirements, reach out to the Crafted team today. We’ll evaluate your needs and configure a software package to fit your unique business model. Don’t hesitate to call on us for help.