The beverage alcohol industry has seen a dynamic shift over the last decade. Beer, once the leading bev-alc drink of choice, officially gave up its position to spirits in 2022. As the demand for beer went down, craft breweries began investigating ways to draw in new customers and create additional revenue streams. At the same time, distilleries recognized the many similarities between beer and spirits – such as equipment, ingredients and production – and created hybrid operations. Thus, the “brewstillery” was born: a brewery/distillery combo that’s elevating craft to a new level.

Product diversification is a proven way for craft beverage companies to open up new growth avenues and gain market share. Brewstillery operations allow craft beverage businesses to cater to a wider variety of consumers, whose palates have become increasingly adventurous over the last several years. But for any brewery or distillery seeking to venture into the other realm, it involves a complex labyrinth of legal stipulations and federal regulations. In short, brewery TTB reporting is not the same as distillery TTB reporting. (And cider is a whole other ball of wax!) Let’s dive into how you can navigate these complexities and begin your journey to business expansion.

The Path of Diversification: Establishing a Brewstillery

Establishing a brewstillery requires a comprehensive understanding of regulations set by the TTB, the U.S. governing entity overseeing the bev-alc industry. While experienced brewers and distillers are each familiar with stipulations surrounding the production, packaging and sale of craft beer and spirits, respectively, it’s important to investigate the distinct requirements of their new product venture.

Creating a brewstillery necessitates careful navigation of these stipulations for successful product line expansion and accurate implementation of new TTB reporting practices. Since the production of beer and liquor require different TTB licenses, it’s critical for owners to have the right tools and information to make informed decisions about legal foundations, TTB licensing and strategic planning. Ensuring all accounting and reporting processes are aligned is no easy task! Let’s dive in below.

How to Navigate TTB Requirements for Dual Operations

There’s a multi-step process of licensing dual operations, starting with understanding each separate license’s requirement and then filing the relevant forms to TTB. Breweries need to file a Brewer’s Notice, and distilleries need to file a Distilled Spirits Plant (DSP) permit. The applications are an essential step in establishing dual operations.

Once you understand the regulations, it’s time to acquire appropriate permits and licenses. Fill out the required paperwork accurately and include details about your brewery and distillery setup in the application. Expect TTB inspections of your setup and financials.

Having the licenses in hand is a monumental milestone in your brewstillery journey. Next up is formulating your plan to expand your product line to create both craft beer and spirits.

Strategic Planning for Product Line Expansion

Adding an additional bev-alc category to your existing product line involves critical growth decisions. For one, you’ll need to evaluate if your current operation has enough space for new brewing or distillation equipment or if you’ll need to relocate your operations. Also, consider if combining a taproom and a tasting room would provide a satisfactory customer experience. Creating an environment that attracts a crowd can play a significant role in your company’s success.

Integrating New Processes into Existing Operations

Breweries need to map out how the distillation process will integrate with the current brewing setup (and vice versa for distilleries). Depending on the scale of operations, new equipment might range from smaller hobby stills to complex canning lines. Select a solution that fits best with your current operation and future expansion plans. Plan for a robust record-keeping system. Compliance reporting to TTB will require accurate and organized records of every brewing and distilling event.

The early stages of establishing a brewstillery can be daunting, but is also a thrilling journey. Next on the roadmap? Conquering the federal and state reporting and compliance requirements.

TTB Reporting and Compliance for Brewstillery Operations

The TTB requires breweries and distilleries to maintain meticulous reports about their production, storage and operations. The dual nature of brewstillery operations compounds these regulations. Effective compliance begins with unified reporting strategies. As mentioned above, brewery TTB compliance reporting requirements are different and separate from distillery compliance TTB reporting requirements, so streamlining your reporting process will help your team operate more efficiently.

Simplifying Compliance through Integrated Reporting

Robust integrated reporting helps consolidate brewstillery reporting into a cohesive, well-oiled structure. If a certain quantity of beer is used in spirit production, accurately reporting it in both the brewery and distillery records simplifies the process. An integrated approach will ensure your records are coherent and help you avoid overlaps or discrepancies, which may lead to penalties during a TTB audit.

Common challenges in brewstillery reporting include misunderstanding or misinterpreting the definitions set by the TTB. Distilleries classify spirits according to proof, but breweries define different beer styles. Accurate categorization of each of your products can circumnavigate potential problems.

Compliance Best Practices for Expanding Product Lines

Following industry best practices can help you avoid mistakes as you navigate the dual regulatory requirements. A well-maintained accounting and production record-keeping solution is the cornerstone of successful TTB compliance. The system should accurately track information ranging from raw materials, fermentation logs and production metrics to finished product data and detailed financials for both beer and spirits. Clear and reliable records ensure a more accurate and effective reporting system and provide a solid foundation for potential audits.

Comprehensive brewstillery software will include TTB reporting features that automatically calculate necessary data from daily brewery and distillery activities. Embracing technology simplifies the reporting process, eliminates human errors and saves valuable time, all of which contribute to seamless operations.

TTB reporting and compliance requirements present an ongoing responsibility for brewstilleries. Appropriate strategies, diligent recordkeeping and effective use of technological tools will help you simplify and surmount these challenges.

The Future of Brewstillery Operations and TTB Compliance

The craft beverage industry is characterized by its passion for innovation – be it in crafting unique beer flavors, distilling niche spirits or embracing complex business models like, say, the brewstillery. This spirit of innovation extends to regulatory compliance where innovative tools and strategies evolve to make compliance and reporting a relatively seamless part of the business.

As federal and state laws evolve, brewstilleries will need to adopt unified reporting strategies, simplified compliance procedures and digital transformation for effective management. Amid these developments, brewstillery entrepreneurs need to stay vigilant about changing regulations and take advantage of emerging tools to ease the compliance journey.

Implementing an All-Encompassing Brewstillery Management Solution

Employing technology solutions provides considerable leverage in managing the complex business processes of a brewstillery. The right fusion of software can significantly simplify management and enhance the efficiency of operations. The software you choose should handle both brewery and distillery operations seamlessly, including all inventory tracking, quality assurance, TTB compliance, accounting and other essential functions within your business.

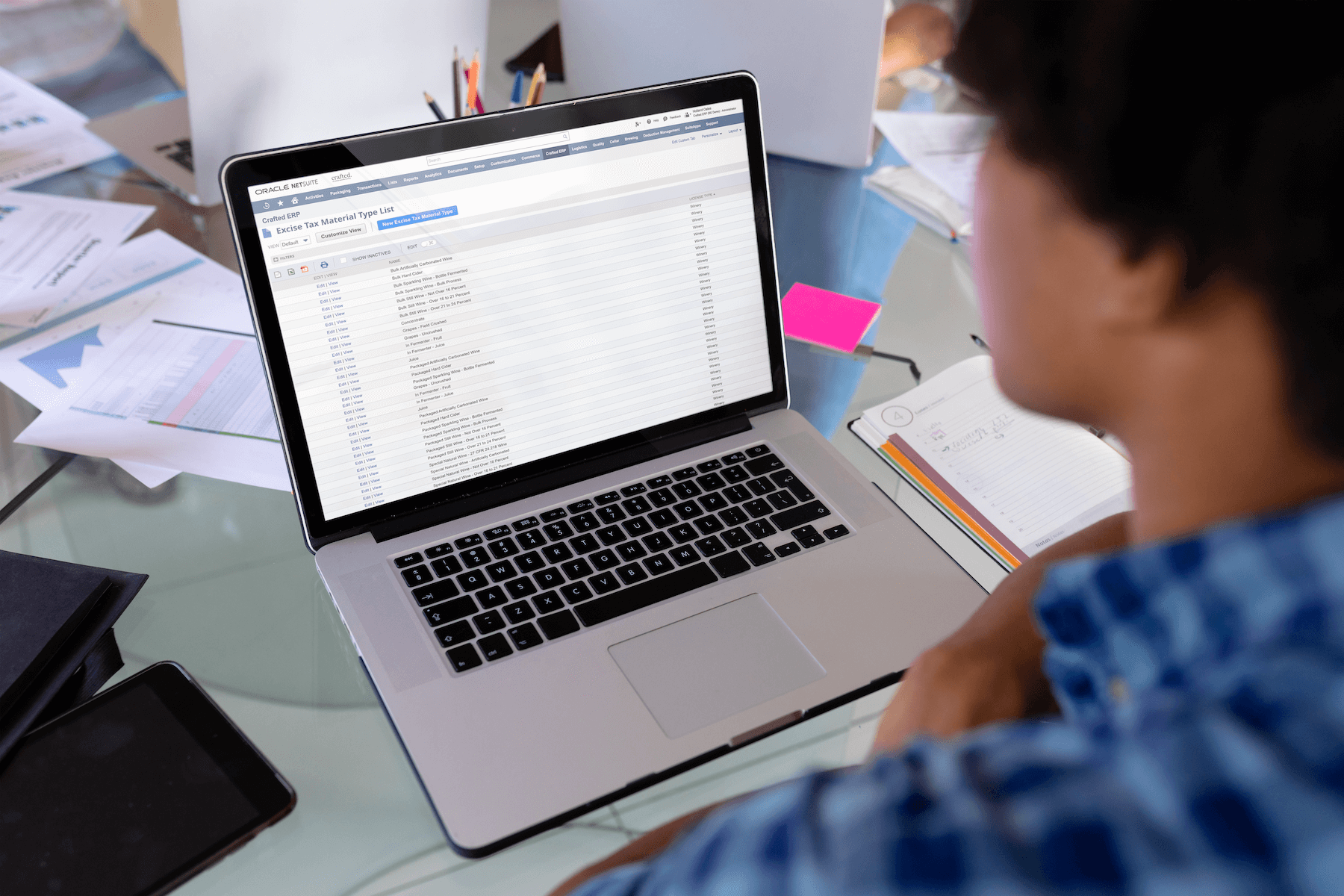

A rewarding journey awaits those who dare to embark, armed with the right knowledge and tools. Crafted ERP BevX is equipped with features to enhance beer and spirits production, manage recipes, track raw materials to finished products, generate sales and customer insights, as well as handle all financial and compliance requirements. In a single solution…with a single login. Cheers to that.

Ready to take the next step? Contact our team of brewing and distilling experts today.

Frequently Asked Questions about Brewstillery compliance

How do I obtain a TTB license for operating a brewstillery that produces both beer and spirits?

To obtain a TTB license for operating a brewstillery, you’ll need to go through a multi-step process that starts with understanding the different licensing requirements for breweries and distilleries. Each type of operation requires a specific license from the Alcohol and Tobacco Tax and Trade Bureau (TTB). Breweries must file a Brewer’s Notice, while distilleries should submit a Distilled Spirits Plant (DSP) permit. You will need to fill out the relevant forms accurately and provide detailed information about your setup. Prepare for TTB inspections of your operation and a review of financials to ensure compliance. It’s vital to maintain a thoroughly compliant operation to successfully obtain the required licenses.

What are the key TTB reporting requirements for breweries and distilleries expanding their product lines?

The key TTB reporting requirements for breweries and distilleries expanding their product lines include the accurate and meticulous reporting of production, storage and operations. Since breweries and distilleries have separate filing requirements, a unified reporting strategy is recommended to streamline the process. Breweries and distilleries are distinguished by their different product classifications, with distilleries sorting spirits according to proof, and breweries defining their products by different beer styles. Accurate categorization and reporting of products are crucial to avoid misunderstandings that could result in penalties during a TTB audit. Consistent and accurate record-keeping is essential for tracking information such as raw materials, fermentation logs, production metrics and finished products for compliance purposes.

What technology solutions can help streamline TTB compliance and reporting for brewstillery operations?

Several technology solutions exist to help streamline TTB compliance and reporting for brewstillery operations. It’s important to find a platform that handles both brewery and distillery production and includes features for TTB reporting. These tools can automatically calculate required data from daily brewery and distillery activities to simplify the reporting process, eliminate potential human errors and save time, money and frustration.

NOTE: The above information should be considered a guide, not the “end all be all” of TTB compliance reporting. Compliance can be incredibly confusing and regulations are constantly evolving. You’ll always want to consult with a lawyer, accountant and/or other industry professional for their expertise prior to making any moves.