When contemplating your exit strategy, an acquisition is likely one of the choices on the horizon. But is your financial house in order? Preparing your finances for acquisition ensures you show up to the table ready to negotiate for the best deal – and improves your chances for a smooth transition down the line.

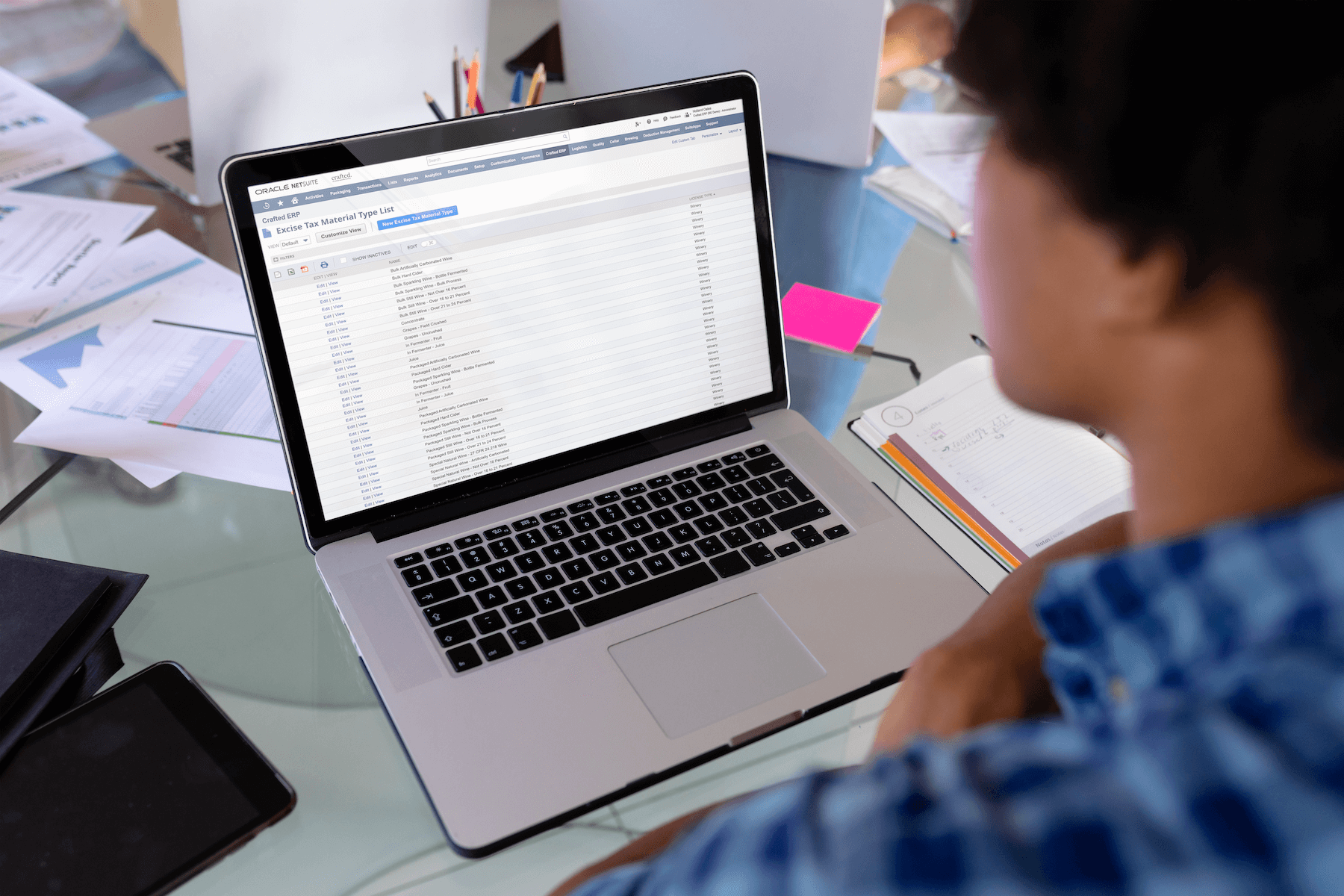

Crafted ERP customer Samson & Surrey is a great example of a multi-brand bev-alc company that wanted to be acquired but struggled to produce an accurate picture of its financial worth. With six unique craft spirits brands, the company faced challenges aligning separate QuickBooks accounts and a variety of other management programs. For instance, Samson & Surrey used three different barrel management programs and a separate distilling program across its operations, none of which could pull consolidated reports.

Samson & Surrey chose Crafted beverage ERP software to unify its brand portfolio and streamline financial processes. The result? Samson & Surrey was successfully acquired by Heaven Hill Brands, the largest independent, family-owned and operated spirits producer in the U.S. in 2022.

Knowing what potential buyers are looking for and how to present it to them is critical when preparing for an acquisition. Businesses typically need to show three to five years of accurate and well-organized financial statements to potential buyers, and additional reports may be requested at any point during negotiations. It’s essential for any bev-alc owner looking to sell or merge to have streamlined processes and a comprehensive database of all financial records.

The Importance of Business Valuation

One of the critical steps in preparing for acquisition is understanding your business’s fair market value. This involves a comprehensive assessment of all your tangible and intangible assets and your debt-to-income ratio. It’s crucial to consider all aspects, including physical assets like buildings, equipment and inventory and intangible assets such as intellectual property and recipes. And let’s not forget about your brand value, which encompasses your market position, brand awareness/perception and goodwill. This understanding is the cornerstone of your financial preparation for acquisition.

Calculating Fair Market Value

To calculate your fair market value, follow these steps:

- Inventory all assets: List all tangible and intangible assets. Ensure you have a comprehensive inventory, equipment, property and intellectual property record.

- Assess debt-to-income ratio: Calculate your current debts versus your income. This ratio helps potential buyers understand your business’s financial health.

- Evaluate brand value: Assess your market position, brand perception and customer loyalty. This can significantly impact your business valuation.

Streamlining Financial Processes

Potential buyers will scrutinize your financial statements from the past several years, which means accurate and organized records are a “need to have.” You don’t want to show up to negotiations with a disorganized mess of a QBO account – or several. To be frank, a bush-league move like that will quickly damage your credibility and valuation.

Here’s how to prepare:

- Implement beverage ERP software: Invest in software tailored to the bev-alc industry that manages accounting, manufacturing, sales, supply chain and every part of your business.

- Produce comprehensive financial statements: Ensure you have up-to-date income statements, profit and loss (P&L) statements and cash flow analyses. These documents provide a clear picture of your financial health and potential earnings.

- Project future revenue and market growth: Provide potential buyers with projections for future revenue and market growth. This can enhance your business’s attractiveness by showcasing its potential.

In preparing their financials for acquisition, Samson & Surrey Vice President of Planning & Operations John Valdes shared, “Crafted specifically allowed us to get IPO and/or acquisition-ready in the sense that it allowed us to get all of our information into one complete solution and that solution was intentional so that anyone who came in to acquire us or an IPO could come in an realize that we have the right controls in place to be a successful organization.”

Understanding Gross Margin

At his talk about how to value a company at the 2021 ADI Annual Conference, Co-Founder and Chief Executive Officer of Samson & Surrey Robert Furniss-Roe emphasized the importance of understanding gross margin during acquisition. He stated, “The reason why gross margin matters not only for building the business but also for people looking at the business is because it’s really the best summary of the overall health of what you built.”

Gross margin is a critical metric that reflects your net sales after taxes and your ability to manage costs. It summarizes your bev-alc business’s overall health and is a key indicator for potential buyers.

Here’s why gross margin matters:

- Reflects business health: Gross margin summarizes how well you’ve managed your business, balancing sales and costs.

- Attracts buyers: A substantial gross margin indicates efficient operations and profitability, making your business more attractive to buyers.

- Supports long-term revenue generation: Operating within a narrow band of gross margin ensures long-term revenue generation and sustainability.

Practical Steps to Improve Gross Margin

To improve your gross margin, consider these practical steps:

- Optimize pricing strategies: Regularly review and adjust your bev-alc business’s pricing strategies to ensure they reflect market conditions and cost changes.

- Reduce costs: Identify areas where you can reduce costs without compromising quality. This could include renegotiating supplier contracts, implementing software to better understand and manage COGS and/or streamlining production processes.

- Increase efficiency: Implement process improvements to increase operational efficiency, reduce waste and improve productivity.

Preparing for Due Diligence

Potential buyers will conduct due diligence to verify your financial statements and business operations during acquisition. To prepare for this, ensure all financial records are well-organized and easily accessible, including:

- Income statements

- Balance sheets

- Tax returns

- P&L statements

Be ready to provide additional reports and documentation as requested, such as:

- Detailed inventory reports

- Sales reports

- Expense breakdowns

Maintaining transparency about any financial challenges or irregularities is crucial, as potential buyers appreciate honesty and may be more willing to work with you if they understand the whole picture.

The Role of Beverage ERP in Financial Preparation

Leveraging technology can significantly enhance your financial preparation for acquisition. Implementing beverage ERP software can unify your financial records, streamline processes and generate consolidated reports, making it easier for potential buyers to evaluate your bev-alc business’s value.

Using industry-specific accounting software ensures accurate financial records management, catering to the unique accounting needs of distilleries, wineries and breweries. “You don’t need a lot of training in order to work Crafted. You can intuitively go in there, especially with the search bar, and ask the system what you want it to do, and it pops it up for you,” explained Valdes.

Additionally, data analytics tools allow you to gain insights into your bev-alc business’s financial performance and identify areas for improvement, helping you make informed decisions and present a compelling case to potential buyers.

Get Your Bev-Alc Business Acquisition-Ready

Preparing your bev-alc business for acquisition requires meticulous financial organization, strategic planning and a keen focus on critical metrics like gross margin. Implementing beverage ERP software, unifying finances across brands and leveraging technology enhances your business’s attractiveness to potential buyers and ensures a smoother acquisition process.

Lisa Wicker, the master distiller and president of Samson & Surrey’s Widow Jane during the acquisition, highlighted the impact of such preparation:

“Crafted [helped] Samson & Surrey and Widow Jane meet our objectives. It [kept] us on task and accountable. Everything from inventory to barrel movement to production to distillation to rebarreling – it’s all there, it’s all there together, it’s all one-stop shopping.”

Ready to take the next step? Start preparing your finances today and set your bev-alc business on the path to a successful acquisition. Contact us to learn more about how we can help you showcase your business’s true value and make it irresistible to potential buyers.

Missed A Post?

This is part 2 of our “final pour” blog series. Get caught up with all our posts on M&A exit strategies for bev-alc business owners.