Just about anyone in the business of producing alcoholic beverages will tell you making money is secondary. It’s art and it’s passion. The industry is full of artisans who start out wanting to share their passion and creativity with others. But as we all know, entrepreneurship in any industry, let alone bev-alc, isn’t for the faint of heart. As a founder or owner in the space, you’ve likely poured your heart and soul (and quite a bit of sweat) into building your brand.

Basil Peters, author, entrepreneur and exit strategy expert says, “Exits are the best part of being an entrepreneur or investor. It’s when we get financially rewarded for all of the creativity, hard work, investment and risk we put into our companies.” Hard as it may be for some, there comes a time to move on – or move up – for every bev-alc pioneer.

The thought of parting ways with a business you’ve nurtured from its infancy can be bittersweet. Yet, the call for a new chapter is often heard loud and clear, whether it’s the whisper of retirement or the roar of new ventures beckoning. The path to a successful exit is multifaceted and requires careful planning and execution.

Exit Strategies for Business Owners

Whatever your reason for wanting to make an exit, there are several options available, each with its own set of pros and cons.

Selling to a Larger Bev-Alc Company or a Group of Investors

Selling to a larger entity or a group of investors can infuse your business with fresh capital and strategic direction – while providing a significant financial return and ensuring business continuity. However, this path often means losing control over the brand and its future direction.

Pros:

- Money, money, money!

- Continuity of the brand

- Access to broader distribution networks and resources

Cons:

- Loss of control over the brand’s direction

- Rigorous due diligence process

- Potential for cultural misalignment with new management

Partner/Employee Buyout

A partner or employee buyout keeps the business within the family, so to speak, and can be a great way to reward and motivate employees while maintaining the company’s culture and values. However, this strategy requires a strong management team and significant financial resources.

Pros:

- Maintains the brand’s ethos and operational continuity

- Rewards and empowers loyal employees or partners

- Smoother transition with less disruption to operations

Cons:

- May require complex financing arrangements

- Potential for internal conflicts during the transition

- Limited access to new capital for growth

Liquidating All Assets and Closing

Sometimes viewed as a drastic measure, this is often the last resort when other options are not viable. Liquidation provides immediate cash but almost always results in job losses and damage to the brand.

Pros:

- Quick resolution when other exit strategies are not viable

- Ability to pay off debts and distribute remaining assets

Cons:

- Loss of the brand and end of business operations

- Potential for lower financial return on assets

- Emotional difficulty in dismantling the business

Key Considerations When Making the Decision

If you think an exit sounds pretty good, get ready: there are busy times ahead! Before you hit the ground running, preparation is critical to a successful exit. Dive into some key considerations that will help you make the best decision for you, your team and your beverage business.

Market Trends and Competitive Landscape

Understanding the current market conditions and the competitive landscape is crucial. This includes researching the overall bev-alc industry and paying close attention to emerging trends or changes in consumer preferences. Consider the local market conditions in your area, including new competitors opening nearby, changes in demographics or customer preferences, and any regulatory or legal changes that could affect operations.

Potential Technology and Process Improvements

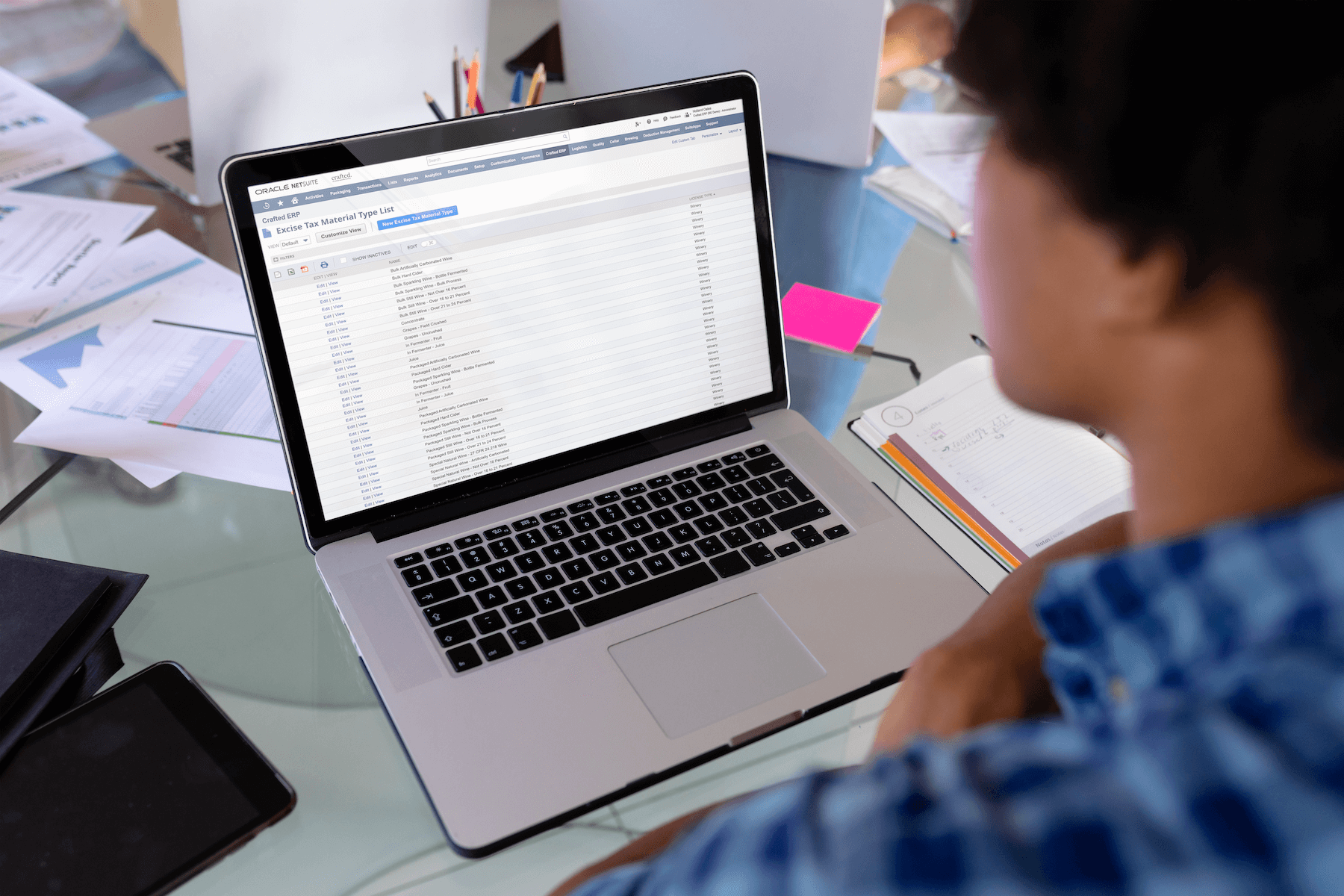

Implementing technology and process improvements can better position your business for your successors, increase its value and make it more attractive to potential buyers. From updating brewing equipment to implementing beverage management software, you can improve your bottom line, shore up your financial reporting and ensure a smooth and profitable transition. Strategic moves like these may present additional exit options than you initially entertained and significantly enhance the value of your beverage business by streamlining operations, ensuring compliance and providing scalability.

Business Valuation

Accurately valuing your beverage business is necessary to get the most from the transaction. Key steps include understanding different valuation methods, performing a thorough financial analysis, considering industry factors and evaluating intangible assets. This isn’t something you should do, nor would you want to, on your own. Employ an outside source to perform an unbiased valuation using multiple methods for a balanced view. Preparing for due diligence and factoring in the business’s long-term potential further ensures a comprehensive valuation.

Timing

Getting the timing right for your exit can make a big difference in both the financial return and the smoothness of the transition. Ideally, preparing for the sale one to two years in advance would be best. This gives you plenty of time to polish your financial records, fine-tune your business structure and build a stronger customer base to boost your business’s value.

Keep scrolling to learn how to make the most of your business during this preparation period.

Maximize Company Value

- Improve profitability: Streamline operations, reduce costs and enhance revenue streams.

- Strengthen customer relationships: Build a loyal customer base and ensure excellent customer service.

- Enhance brand reputation: Invest in marketing and public relations to boost brand recognition and reputation.

Enact Your Succession Plan

- Identify potential successors: Whether internal or external, identifying a successor early can ensure a smooth transition.

- Develop a transition plan: Outline the steps and timeline for the transition to minimize disruption.

- Communicate clearly: Make it a priority to inform and involve stakeholders in the transition process as appropriate.

Review and Act on Legal and Financial Considerations

- Tax implications: Understand the tax consequences of selling or transferring the business.

- Regulatory compliance: Ensure the business complies with all relevant regulations and industry standards.

- Financial records: Maintain accurate and up-to-date financial records to facilitate the sale process.

From Passion to Transition

Exiting a beverage business is as much an art as concocting the perfect sip. The people who embark on this journey are filled with passion, creativity and a relentless drive. Yet, even the most dedicated entrepreneur eventually hears the call for new adventures or well-deserved rest.

Preparing for this transition involves strategic planning and thoughtful execution. By understanding your exit options, you can choose the path that best aligns with your goals.

Timing is critical; ample preparation can maximize your company’s value and ensure a smooth transition. With this next chapter before you, remember that your legacy lives on in the brand and the loyal customers who’ve shared in your journey.

Dive Deeper

This is only the beginning. Check out our entire 4-part blog series, where we explore:

We’re always here to help! If you’re thinking about your exit strategy or planning for an acquisition of your bev-alc, contact our team of industry veterans who can offer advice and help you develop a comprehensive plan.